Risk Management

ERM and Capital Policy

Recognition of the environment and basic strategy

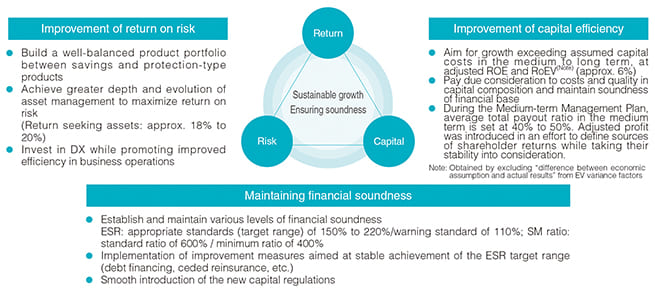

The Risk Appetite Statement stipulates that we shall realize sustainable growth and enhancement of the Company's corporate value over the medium to long term while securing soundness in business management based on ERM. We will aim to secure revenues considering efficiency with respect to capital and risks, while securing financial soundness.

On top of that, we will position returning profits to shareholders as an important measure for management effectiveness. We will secure revenues while maintaining financial soundness based on ERM, aiming to steadily return profits to shareholders.

Key Initiatives

We intend to improve the risk return ratio and capital efficiency while maintaining financial soundness under the ERM framework.

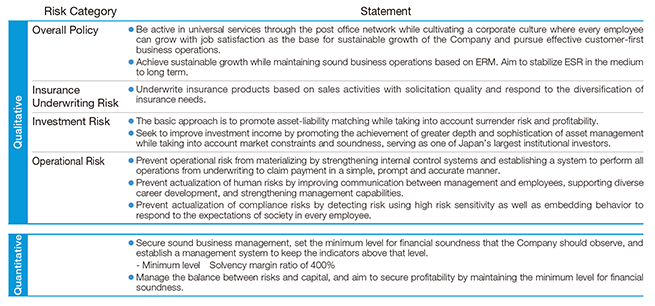

Risk Appetite Statement

The Risk Appetite Statement stipulates our risk-taking policies in terms of which risks to take in order to achieve our goals. We categorize our risk appetite into "qualitative risk appetite" and "quantitative risk appetite."

Risk Management Systems

Outline of Risk Management Systems

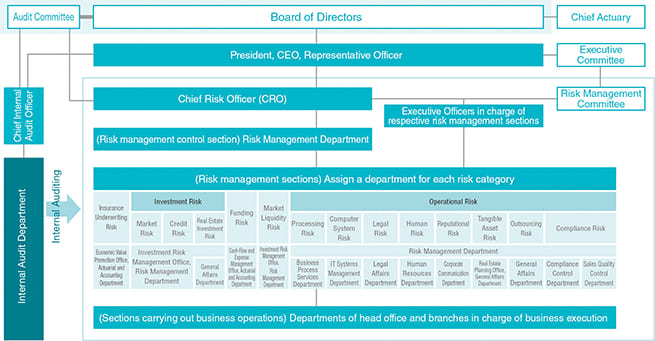

In accordance with the "Basic Risk Management Policy," we have set up and regularly convene the Risk Management Committee headed by the Chief Risk Officer (CRO), while formulating rules of risk management.

The Risk Management Committee deliberates on risk management policies and matters concerning the establishment and operation of risk management systems as well as on matters concerning the implementation of risk management. This committee also performs appropriate risk management by monitoring and analyzing the status of each risk and other related matters. The CRO submits and reports on important matters to the Executive Committee, the Audit Committee, and the Board of Directors for discussion.

Also, the CRO controls the Company's risk management and builds, verifies and upgrades risk management systems in accordance with changes in risk management circumstances and the operating environment. The Risk Management Department is in charge of overall control of risk management and under the direction of the CRO executes affairs concerning building, verifying and upgrading risk management systems. At the same time, it regularly verifies the status of risk management by monitoring, analyzing and managing the state of risk management in sections responsible for performing risk management in each risk category ("risk management sections").

Each of the Executive Officers in charge of risk management sections operate and upgrade the systems for managing their respective assigned risks by ascertaining the presence, types and profile of risk, as well as the risk management techniques and systems as prescribed by the Basic Risk Management Policy. While operating a mutual checks and balances system with departments of the head office and branches in charge of business execution, risk management sections appropriately fulfill their monitoring role and manage their assigned risks in accordance with risk management standards. As investment risk and operational risk have multiple subcategories, we have designated a department for handling comprehensive risk management in conjunction with the risk management sections for respective subcategories.

The Internal Audit Department conducts internal audits to check the status and operation of the risk management systems, as well as to strengthen them.

In enforcing risk management, we collaborate with the risk management departments of Japan Post Holdings Co., Ltd. and JAPAN POST INSURANCE SYSTEM SOLUTIONS Co., Ltd., the Company's subsidiary.

Risk Management Structure

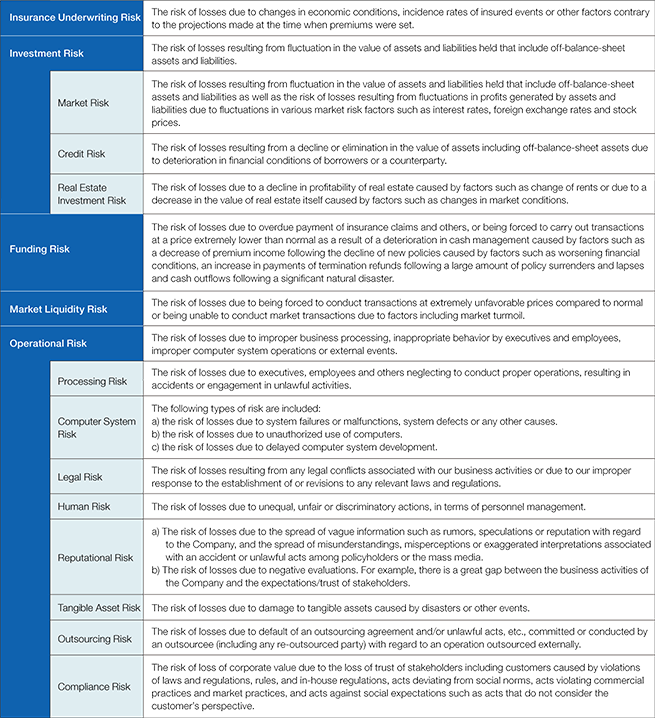

Principal Risk Categories and Definitions

We classify and define types and details of managed risks into the following categories, and have established a management system and rules in accordance with each characteristic and are appropriately carrying out risk management.

Implementation of Stress Tests

We implement periodic stress testing to ascertain the impact of an event that has a low but certain probability of occurring and could have a significant effect on the Company. In establishing stress scenarios we undertake the following:

- We cover all risk categories that could have a significant impact on the Company taking into consideration the Company's risk profile status.

- Besides historical scenarios that have occurred in the past, we simulate forward-looking hypothetical scenarios that could occur in the future.

- We consider the impacts on the Company under a combined (comprehensive) stress scenario.

Specifically, it is a combination of events such as significant fluctuations in financial markets such as interest rates, exchange rates and stock prices, the occurrence of a major earthquake or a pandemic. In addition, we are working on estimates and analyses of the impact of climate change (long-term global warming) on assets owned, insurance claim payments, etc.

Based on the analysis of the impacts on loss situation and soundness under the stress scenarios, the results of stress tests are periodically reported to the Risk Management Committee and the Executive Committee to be used in management judgments.

Business Risks and Other Risk Factors

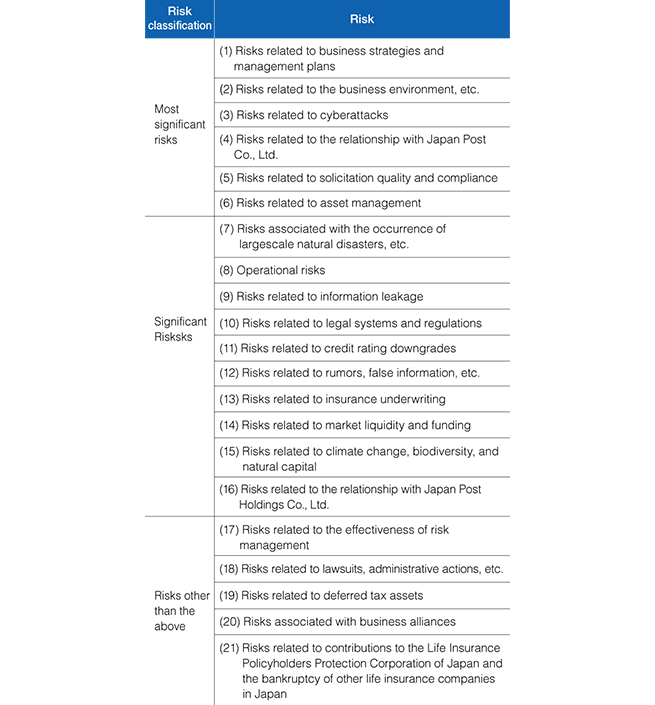

The following are the major risks that management believes may have a significant impact on the Group's financial position, operating results, cash flow status, and indicators such as embedded value (EV), which represents corporate value.

The Group classifies business risks and other risk factors into: most significant risks, significant risks, and risks other than the above. In classifying such risks and describing the information related to each one, we conducted a questionnaire regarding business risks and other risk factors directed at members of the Executive Committee as of March 31, 2023, who were executive officers at or above the level of managing executive officer and those in charge of business operations as of March 31, 2023, in order to appropriately reflect the Group management's awareness of the impact, possibility of occurrence, and countermeasures. Based on the aggregate results, the Risk Management Committee and the Executive Committee discussed the results and listened to the opinions of Outside Directors.