Main Text starts here.

About Us

What We Are (Our Advantage)

Business Development Centering on Post Offices

We provide simple and easy-to-understand products with smaller coverage amounts focused on endowment insurance and whole life insurance and various services through the nationwide network of post offices, and operate a unique business model that differs from that of competitors in Japan.

※1 Retail Service Division is established as a branch organization of Japan Post Insurance located at a particular post office which the branch is in charge of.

※2 The number of customers is the sum of policyholders and insured persons (including individual insurance and individual annuities as well as Postal Life Insurance reinsured by us).

Japan Post Insurance by numbers

As of March 31 , 2025

※1 Adjusted profit is the Company’s proprietary indicator to partially adjust for the effect, etc. unique to life insurance companies where an increase in new policies lowers profits in the short term, and is defined as the sum of consolidated net income, adjustment to policy reserves (after tax) and amortization of goodwill. The amount of the adjustment to policy reserves is the amount calculated by subtracting the amount of provision for policy reserves calculated by the factor used for premium calculation from the amount of provision for standard policy reserves related to new policies in the current fiscal year.

※2 The amount of insurance claims and others paid is the sum of insurance claims, annuity payments, and benefits paid during the fiscal year ended March 31, 2025. Insurance claims include cancellation refunds, etc. at the Organization for Postal Savings, Postal Life Insurance and Post Office Network.

Sales/Service Channels

Through the nationwide network of post offices, Japan Post Insurance branches and Retail Service Division※1 offices, we provide our products and services to individual customers and corporate customers.

As of March 31 , 2025

※1 Retail Service Division is established as a branch organization of Japan Post Insurance located at a particular post office which the branch is in charge of.

※2 The numbers in () are the number of Contracted post offices in each area.

Individual customers (post office counters and Retail Service Division offices)

Post office counters provide simple and easy-to-understand products (with smaller coverage amounts and easy procedures) and services to visitors. Retail Service Division offices provide them by visiting individual homes.

Corporate customers (Japan Post Insurance branches)

Japan Post Insurance branches provide our company products and services to corporate customers by visiting companies, and also handle other life insurance companies' products for corporate customers.

Major products sold

Our products cover basic protection that pays death benefits, maturity benefits, and survival benefits with medical care protection (riders) for injuries and illnesses. We provide simple and easy-to-understand products (with easy procedures and smaller coverage amounts) and services, focusing on endowment insurance and whole life insurance, through the nationwide network of post offices.

※1 Up to 120 days per hospitalization

※2 Up to 5 times per hospitalization

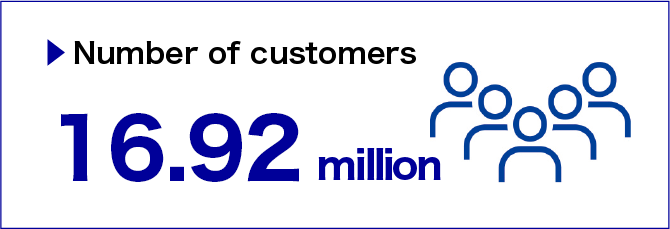

Extremely Large Customer Base

Our approximately 16.92 million customers is equivalent to roughly 14% of Japan’s population (as of April 1, 2024). ※1

※1 Source: Population Estimates (Statistics Bureau of Ministry of Internal Affairs and Communications; total population as of April 1, 2025 (provisional estimates))

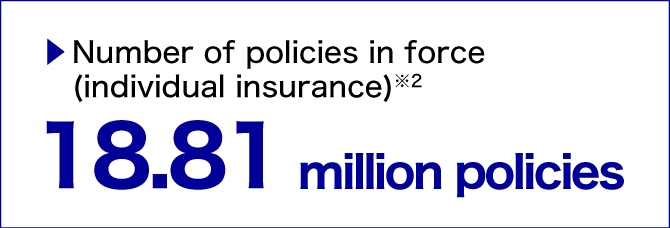

※2 The number of policies in force includes Postal Life Insurance reinsured by us.

Relate starts here.