Initiatives for Biodiversity Conservation

Together with climate change, the protection of the natural environment and the ecosystems that support it is a critical issue of global importance. Having established "Contribute to environmental conservation that nurtures abundant nature" as one of our Materiality (Important Issues), we are engaging in the following initiatives to fulfill both the SDGs and our own sustainable growth.

Initiatives for the Taskforce on Nature-related Financial Disclosures (TNFD) Recommendations

The TNFD is an international initiative to develop a framework for the appropriate evaluation and disclosure of business risks and opportunities related to natural capital. Its final recommendations were published in September 2023.

The Company endorses the philosophy of the TNFD and, in June 2023, joined the TNFD Forum, which supports the activities of TNFD, before then registering as an Early Adopter(*) in December 2023. Moving forward, we will continue to work toward ensuring that our disclosures are in line with TNFD recommendations.

- (*)

- Companies and organizations that registered their intention to disclose information in line with TNFD recommendations by January 10, 2024.

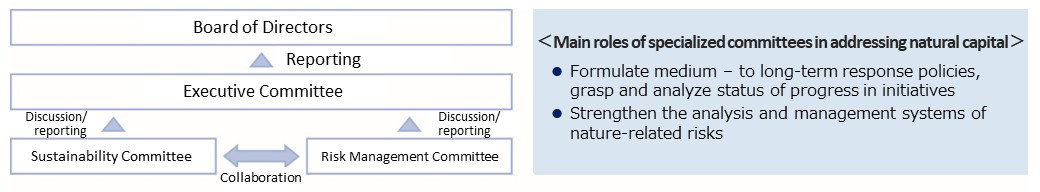

Governance

(1) Governance Structure

At our Company, the Sustainability Committee, chaired by the Executive Officer in charge of the Sustainability Promotion Department, and the Risk Management Committee, chaired by the Chief Risk Officer (CRO), review and discuss various issues related to biodiversity conservation and natural capital.

The status of these reviews and discussions is reported to the Executive Committee, and particularly important issues are discussed at the Executive Committee before then being decided on by the President, CEO, Representative Executive Officer.

In addition, reports are made to the Board of Directors on a regular basis, and a framework has been established in which the Board of Directors appropriately monitors the status of biodiversity and natural capital response and, as necessary, supervises related policies, targets, strategies, and plans.

(2) Engagement with indigenous peoples, local communities and affected stakeholders to ensure respect for human rights

The Company's human rights policy states that we do not tolerate discrimination of any kind based on race, color, gender, sexual orientation, gender identity, language, religion, politics or creed, nationality or social origin, poverty or wealth, birth, disability, etc.

We have initiated human rights due diligence initiatives based on the framework of the United Nations Guiding Principles on Business and Human Rights, as well as various Japanese and international guidelines, among others.

This is an ongoing process to prevent and mitigate negative impacts on human rights in our corporate activities. We will strive to achieve respect for human rights and sustainable business by implementing this process on a regular basis, taking into account the opinions of outside experts.

We recognize the possibility that the Company's business activities, as realized through the actions of our investees, may have a negative impact on the rights of local ethnic groups and indigenous peoples. In order to mitigate such risks, the Company strives to be a responsible institutional investor that will always factor in human rights considerations whenever making decisions over where to invest or when engaging in dialog with companies who we are investing in.

Strategy

1.An Operating Company

The Company utilizes the LEAP approach to analyze nature-related risks and opportunities, as recommended by the TNFD.

Locate: Identifying Points of Contact with Nature

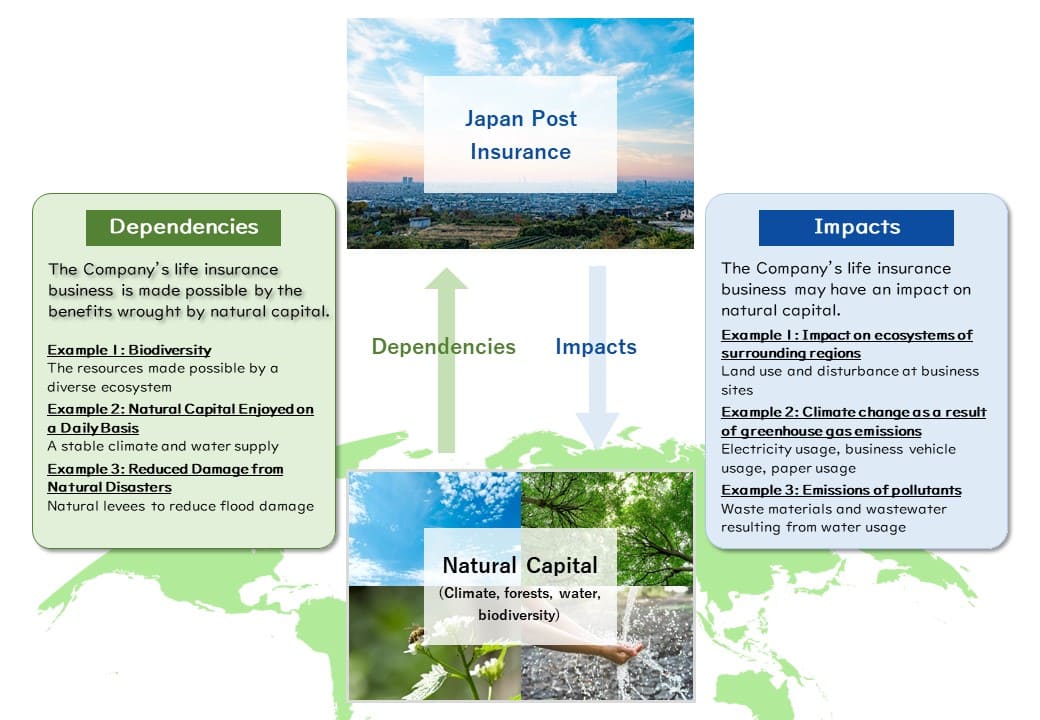

Based on the results of "ENCORE" (*1), a nature-related risk analysis tool recommended by the TNFD, we have identified the points of contact between the Company's life insurance business and natural capital from the perspectives of dependencies and impacts (*2) on said natural capital.

- (*1)

- A nature-related risk analysis tool developed by the Natural Capital Finance Alliance etc.

- (*2)

- Dependence: How our business benefits from natural capital, including through the supply of water and natural environments that help mitigate flooding.

Impact: How our business activities change natural capital, including through greenhouse gas emissions and land use.

Evaluate: Evaluating our dependencies and impacts on nature

Based on the identified points of contact with natural capital, we evaluated the relationships of dependencies and impacts between our Company's life insurance business and nature. The details are as follows:

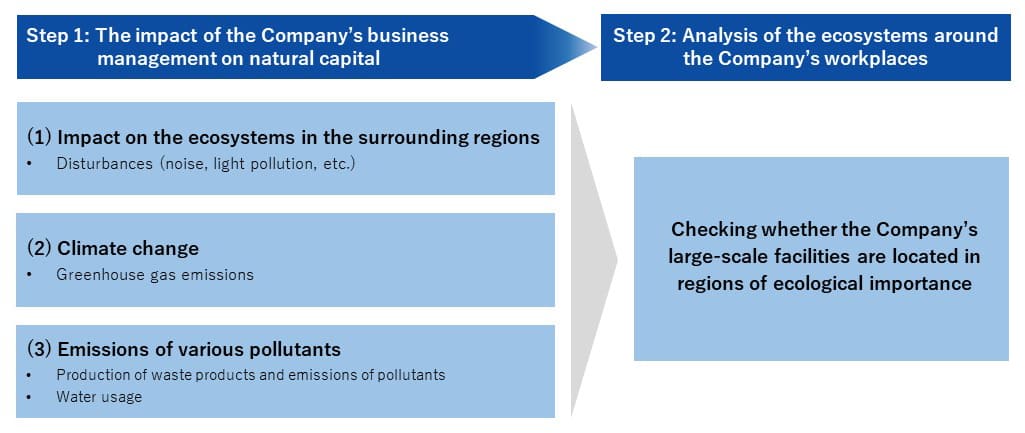

≪Evaluation of Level of Impact≫

In Step 1, we performed an analysis based on the following three major factors: (1) Does the Company's business management impact the ecosystems of surrounding regions? (2) Does the Company's business management impact climate change? (3) Does the Company's business management produce emissions of pollutants?

In Step 2, we checked whether the Company's large-scale facilities are located in regions of ecological importance.

[Step 1] The impacts of the Company's business management on natural capital

(1) Impacts on ecosystems of surrounding regions

The Company uses its land for business applications (office buildings). We investigated whether the Company's business management may cause disturbances* (noise, light pollution, etc.).

- (*)

- Disturbance refers to things that impact the ecological balance of the plants and animals in surrounding areas, for example, generating loud noises or using bright lights outdoors.

- The use of office buildings must have a low possibility of causing noise pollution.

- Exterior lighting may be used for the purposes of crime prevention; however, the lighting must not be so bright as to light up the surrounding environment. Also, a set level of lighting to be used within the Company's places of business must be established and this light level must be appropriate so as not to result in light pollution.

Based on the above, we believe that the impacts of any disturbances on the surrounding environment from the Company's places of business are low.

(2) Climate change

There is a possibility that, in operating its life insurance business, the Company may impact climate change through the emissions of greenhouse gases.

We have measured the levels of greenhouse gas emissions from the following three sources: Vehicles and other things used in the course of our business activities (Scope 1); electricity usage at our business facilities (Scope 2); and paper usage relating to the provision of terms and conditions and other such documentation to customers (Scope 3). We then set out a range of initiatives aimed at reducing our emissions of greenhouse gases from these sources. For more information, please refer to the Initiatives for Climate Change page.

(3) Emissions of various pollutants

Although we recognize that our various places of business do produce general and industrial waste as well as wastewater, due to the nature of the life insurance business as one which handles intangible products, we believe that our emissions of pollutants are minor in their significance. Further, we also treat the waste that we do produce, including through recycling, meaning that our impacts on natural capital are, again, minor in significance.

[Step 2] Analysis of the ecosystems around the Company's workplaces

Based on the results of Step 1, we believe that the possibility is low that our business management damages the balance of the ecosystems surrounding our places of business; however, there is a risk that any large-scale land-development, such as the construction of large buildings in line with the expansion of our business, may destroy the ecological balance of surrounding environments and result in public demonstrations or lawsuits.

Therefore, we ran checks to see if any of our nine large-scale facilities were located in Ramsar sites (wetlands), wildlife protection areas, national parks, or Nature Conservation Area. The results of these checks confirmed that none of our large-scale facilities were located in any such areas.

However, we did confirm that the Fukuoka Service Center, which is one of our large-scale facilities, is located 5.7 kilometers from the designated Hakata Bay wildlife protection area. Hakata Bay is recognized as a wintering area for the black-faced spoonbill, which was designated as Threatened IB on the Red List 2020 of the Ministry of the Environment. Given the fact that one of the Company's places of business is located close to a region of ecological importance to wild birds, the Company makes financial contributions to conservation activities for wild birds in the form of support for activities aimed at conserving species and restoration of natural capital.

Based on the results of the above evaluation and analysis, we believe that the possibility that the Company's life insurance business activities will have a significant impact on biodiversity and natural capital is low. In spite of this, we will continue to engage in efforts to conserve biodiversity and natural capital.

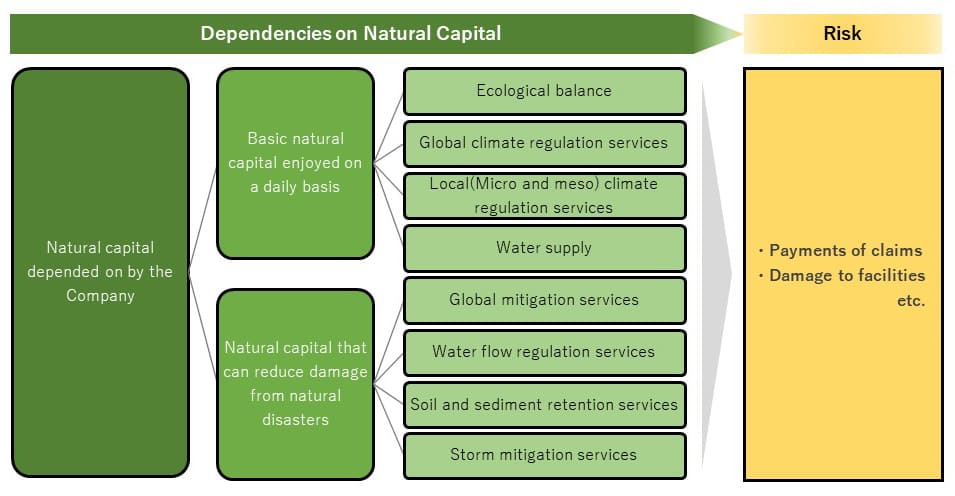

≪Evaluation of Level of Dependency≫

Next, from the perspective of the Company's dependencies on natural capital, it is thought that the Company is able to carry out its business activities in a stable manner owing to the benefits of "Natural Capital Enjoyed on a Daily Basis" and "Natural Capital That Reduces Damage from Natural Disasters." There is a possibility that our dependencies on these forms of natural capital may present risks to our life insurance business. (For details, please refer to "Assess: Assessing Important Risks and Opportunities" later in this document.)

Assess: Assessing Important Risks and Opportunities

Based on the results of our analysis into our dependencies and impacts on natural capital, the Company's Sustainability Committee has examined risks and opportunities related to natural capital as they pertain to the Company's life insurance business, identifying the following as matters of particular importance:

<Risks and Opportunities in Life Insurance Business>

| Type | Content | Timeline of impact |

|---|---|---|

| Physical Risks(chronic) | Rise in insurance claim payment due to wide spread, etc. of infectious diseases from the collapse of ecological balance | Long term |

| Physical Risks(acute) | Risk of data centers becoming damaged in natural disasters such as flooding and large storms, resulting in delays or even suspensions of operations | Short term |

| Transition Risks | Damage to the Company's reputation among society, investors and other stakeholders due to a deemed failure to take adequate measures to address nature-related issues | Short to medium term |

| Opportunities |

Changes in consumers' insurance needs such as rising demand for products and services related to maintaining health, etc. Efforts by the Company to conserve natural capital will be well received, improving the Company's reputation among investors, increasing the number of insurance contracts concluded, and helping the Company attract the best human resources. Efforts to promote recycling will improve the sustainability of our business environment while going paperless will help reduce costs. |

Medium to long term |

- (*1)

- In identifying the risks and opportunities mentioned above, we disclose risks and opportunities with high degree of impact based on their importance to the Company's business after identifying large and small potential risks.

- (*2)

- We assume that the timeline of impact will be as follows: short term: 5 years, medium term: 15 years, long term: 30 years.

We have also analyzed the issues of increases in payments claims and damage to data centers caused by natural disasters. The details of this analysis are as follows:

(1) Rise in insurance claim payment due to wide spread, etc. of infectious diseases from the collapse of ecological balance

There is a possibility that a loss of balance in the ecosystem as a result of climate change and other factors may impact on the health of people, which may, in turn, impact the amount of claims paid by the Company. We recognize that, presently, there is no commonly established scenario regarding the spreading of infectious diseases as a result of a loss of balance in the ecosystem. For this reason, we consider it difficult to perform any sophisticated analysis or measurements of the issue at this current time.

However, by estimating the way in which rises in global temperatures may cause the expansion of areas and periods of activity in which mosquitos, which are a vector of infectious diseases, are active, and then analyzing how this may increase payment claims for tropical infectious diseases transmitted by these mosquitos, such as Dengue fever and malaria, we were able to come to the following calculation (assuming yearly instances in the period 2031 to 2050): The increase in the amount of payments claims would top out at roughly 20 billion yen over the cumulative 20 year period.We confirmed that the increase in claim payments will have a limited impact on our financial soundness, given the extremely small amount compared to the Company's actual death benefit payments and the fact that we are able to make payments from the policy reserves we have built up in preparation for future payments.

(2) Risk of data centers becoming damaged in natural disasters such as flooding and large storms, resulting in delays or even suspensions of operations

The Company operates in a region in which its business management may be impacted by natural disasters and so has identified data centers, which are subject to physical risks (water risk), as priority locations from the perspective of the potential size of impact in the event of a natural disaster.

In the event of flooding or similar other disaster in the areas surrounding our data centers, we assume that there is a risk that the buildings containing the data centers will be damaged and that there will be delays in our business operations.

Our data center buildings have already taken preparative measures against flooding, such as the building of embankments, and, so, we believe that the risk of actual flooding is low. In the unlikely event that electricity to the buildings is cut off, we have installed back-up power generation facilities that can provide several days' worth of power. In addition, we have installed bypass systems for circulating used water in the tanks for in the event that the water used for humidifying the building is cut-off. These are some of the measures we have already implemented to reduce the risk to our data centers.

We have formulated a business continuity plan (BCP) in preparation for the occurrence of a large-scale disaster, including initial responses in the event of a disaster and a plan to continue business activities at another site in the event that the functions of an important site are suspended. In addition, we assess the risk level of our business sites and business areas based on hazard maps, etc., and formulate response plans and conduct drills as appropriate for sites located in areas that are particularly vulnerable to flood damage.

Looked at holistically, we do not believe that nature-related risks such as those from natural disasters are likely to have a significant impact on our life insurance business. However, we will continue to regularly assess nature-related risks.

Prepare: Preparing for responses and reporting

Based on the risks and opportunities identified above, we are moving forward with initiatives geared toward the conservation of biodiversity and natural capital. Some of the initiatives we have been working on include the making of financial contributions to conservation activities, promoting the move toward paperless operations, reducing the use of plastic, and cleanup activities at the local communities at each of our bases.

Supporting the conservation of biodiversity and natural capital

[Support for biodiversity conservation]

The Company has been making financial contributions to activities to help protect wild birds in the form of initiatives to protect species and restore natural capital.

[Support for forest conservation]

We make donations to support forestation activities conducted by citizens' groups and other organizations to revitalize forests and lead to efforts to increase greenery.

Efforts to Reduce Paper Consumption (Going Paperless)

We strive to reduce CO2 emissions by reducing the amount of paper used towards a paperless workplace.

<Main initiative>

- Provision of notices from the Company (Notice of Policy Details, etc.) through My Page instead of by mail

- Electronic issuance of premium payment certificates

- Provision of the Contract Guidelines and Policy Conditions in PDF format on our website in addition to the printed version

- Encouragement of a reduction of copier paper, and digitization of various office forms

Please see the page below for more details on other environmental conservation activities.

2.An Institutional Investor

As an institutional investor, we have a hand in the activities of our portfolio companies, including when these activities relate to the natural world. Our investment and loan portfolio can therefore be considered to have the following nature-related risks and opportunities.

<Risks and opportunities>

Nature-related risks and opportunities in investment and financing activities

| Type | Our Recognition |

|---|---|

| Physical Risks | Increased costs for portfolio companies due to the decline, deterioration, and depletion of natural assets and ecosystem services on which portfolio companies depend, such as water resources, and loss of value of portfolio assets due to production disruptions |

| Transition Risks | Increased costs for portfolio companies due to stricter environmental protection laws and social demands, litigation risk, and loss of value of investment assets due to increased reputational risk |

| Opportunities | Increase in the value of portfolio companies and expansion of investment and financing opportunities due to the need for environmentally protective technologies and alternative products and services with a smaller environmental impact |

<Dependencies and impacts>

Companies depend on natural capital to conduct their business activities, but also impact natural capital through those business activities. To determine the nature-related dependencies and impacts that we should emphasize in our portfolio, we prepared sector-based heatmaps. We selected sectors based on (1) assessments of the degrees of dependence and impact of each sector performed using ENCORE, (2) our investment balance in each sector, and (3) the TNFD priority sectors, and attempted to visualize the nature-related risks we should focus on.

Heatmap of major nature-related dependencies and impacts of our equity and corporate bond portfolios

<Method of Selection of Sectors Shown in the Heatmaps>

(1) Based on the ENCORE assessment of dependence and impact in each sector, we put the overall degrees of dependence and impact for each sector into numerical form.

(2) We specified sectors in the top one-third for (1) degrees of dependence and impact and in the top one-third for our investment balance.

(3) From among the sectors in (2), we selected ones corresponding to the TNFD "priority sectors"

Regarding dependence, the results revealed heavy reliance on water resources in sectors such as electric utilities, food & beverages, and integrated oil & gas. As for impact, the results showed effects on terrestrial, freshwater, and marine ecosystems from infrastructure construction etc. in sectors such as electric utilities, integrated oil & gas, and construction & engineering, as well as effects caused by water use and pollution/waste in many sectors. We will therefore need to keep a close eye on the situation with these impacts.

This analysis is in its initial stages, assuming each industry in general. Going forward, we plan to analyze and disclose the risks and opportunities of our portfolio with respect to nature in terms of the TNFD framework. In addition, based on the results of our analysis and demands from society, we will incorporate nature-related issues into our investment decisions, engage appropriately with portfolio companies on nature-related topics, and make investments that contribute to the maintenance and improvement of the natural environment.

Investment Examples

Investment in Blue Bonds issued by the Republic of Indonesia

We invested in Blue Bonds(*) issued by the Republic of Indonesia, the world's largest island nation.

The funds raised through this bond issue will be used for projects that contribute to the development of the blue economy as defined in the SDGs Government Securities Framework developed by the Government of Indonesia.

- (*)

- Bonds whose use of funds is limited to projects related to the water environment, such as improvement and conservation of the marine environment, sustainable fishing, and prevention of marine pollution.

Investment in a Sustainable Development Bond

In March 2021, we invested in a sustainable development bond, which supports the One Health approach for protecting the "health" of people, animals, and the global environment as one.

©Inter-American Development Bank

Risk and Impact Management

Our Company has established a system to identify and assess the risks of negative impacts on biodiversity conservation and natural capital risks on a company-wide basis, with the Sustainability Promotion Department in charge of risk assessment and the Risk Management Department in charge of overall risk management, and reports the results to the Risk Management Committee. The Company will continue to identify and assess risks at least once a year, and further enhance our risk management system. The results are also reported to the Sustainability Committee as part of our initiatives in response to address TNFD recommendations.

Metrics and Targets

We monitor the following metrics in order to assess and manage dependencies, impacts, risks, and opportunities related to nature.

| FY2023 | Unite | ||

|---|---|---|---|

| GHG emissions(Scope1) | 10494.2 | tCO2 | |

| GHG emissions(Scope2) | 11559.8 | tCO2 | |

| Water Consumption(*) |

Water supply | 36.8 | 1000㎥ |

| Sewerage | 28.8 | 1000㎥ | |

| Amount of general waste(*) | 484.1 | t | |

| Amount of general waste recycled | 419.1 | t | |

| Amount of industrial waste emissions(*) | 169.5 | t | |

| Amount of industrial waste recycled | 139.1 | t | |

| Total floor space | 352,140.7 | ㎡ | |

- (*)

- The above data is for our head office locations and large-scale facilities (Otemachi Place West Tower and Osaki Bright Tower, Sendai Service Center, Gifu Service Center, Kyoto Service Center, Fukuoka Service Center, Information Management Center, Kyoto Okazaki Bldg.).

In addition, we have set targets for reducing greenhouse gas emissions (GHG emissions), and are working on initiatives aimed at realizing carbon neutrality.

At present, we have not set targets that correspond to the TNFD core global disclosure metrics; however, we will continue to work on improving the methods we use to evaluate and manage metrics related to natural capital conservation.

| Type of emission | Category | Reduction targets | |

|---|---|---|---|

| Interim target | 2050 | ||

| Emissions from our operating company | Scope1 | 46% reduction in greenhouse gas emissions from FY2019 levels by the end of FY2030 | Aim to achieve carbon neutrality |

| Scope2 | |||

| Emissions from our investment portfolio(*1) | Scope3 Category15 |

50% reduction in greenhouse gas emissions from FY2020 levels by the end of FY2029(*2) | |

- (*1)

- Total emissions of Scope 1 and Scope 2 from investee companies (domestic and foreign listed equities and corporate bonds including corporate loans) after calculating by the ratio of our holdings.

- (*2)

- We aim for a 50% reduction, measured as of March 31, 2030, compared to GHG emissions from our investment portfolio as measured on March 31, 2021.