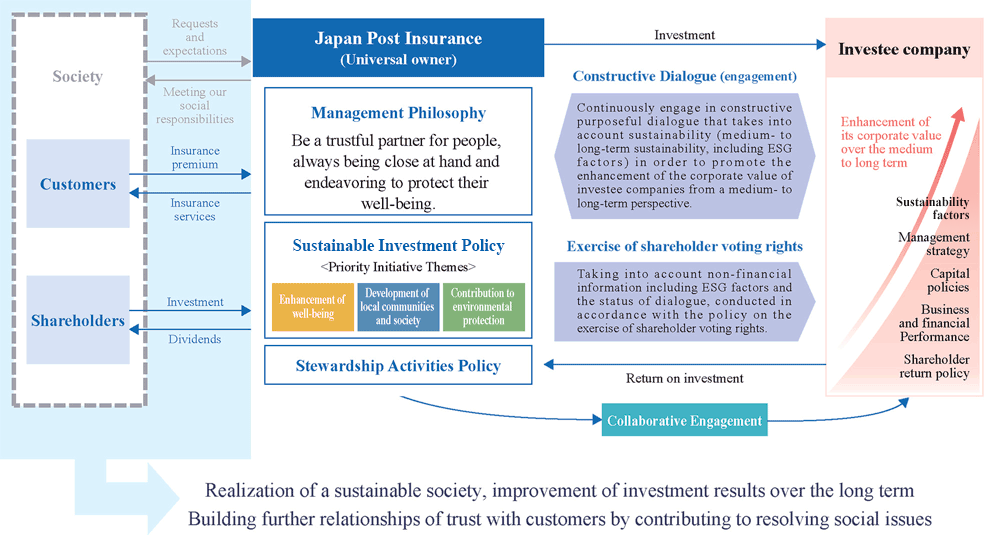

Stewardship Activities

We have been promoting stewardship activities as a universal owner that manages diverse, long-term assets, in order to fulfill our responsibilities and respond appropriately to social demands for compliance with the Japan's Stewardship Code.

Through constructive dialogue (engagement) with portfolio companies, we aim to enhance corporate value over the medium to long term. Moreover, we seek to accurately understand their situations, including aspects such as their sustainability issues and their medium- to long-term management strategies for addressing them. In addition, by directly engaging with portfolio companies on issues such as Board of Directors composition, officer remuneration, shareholder returns and other capital policies, information disclosure policies, climate change, biodiversity, human rights, and human capital, we confirm their efforts to address sustainability issues, and share a recognition of these issues.

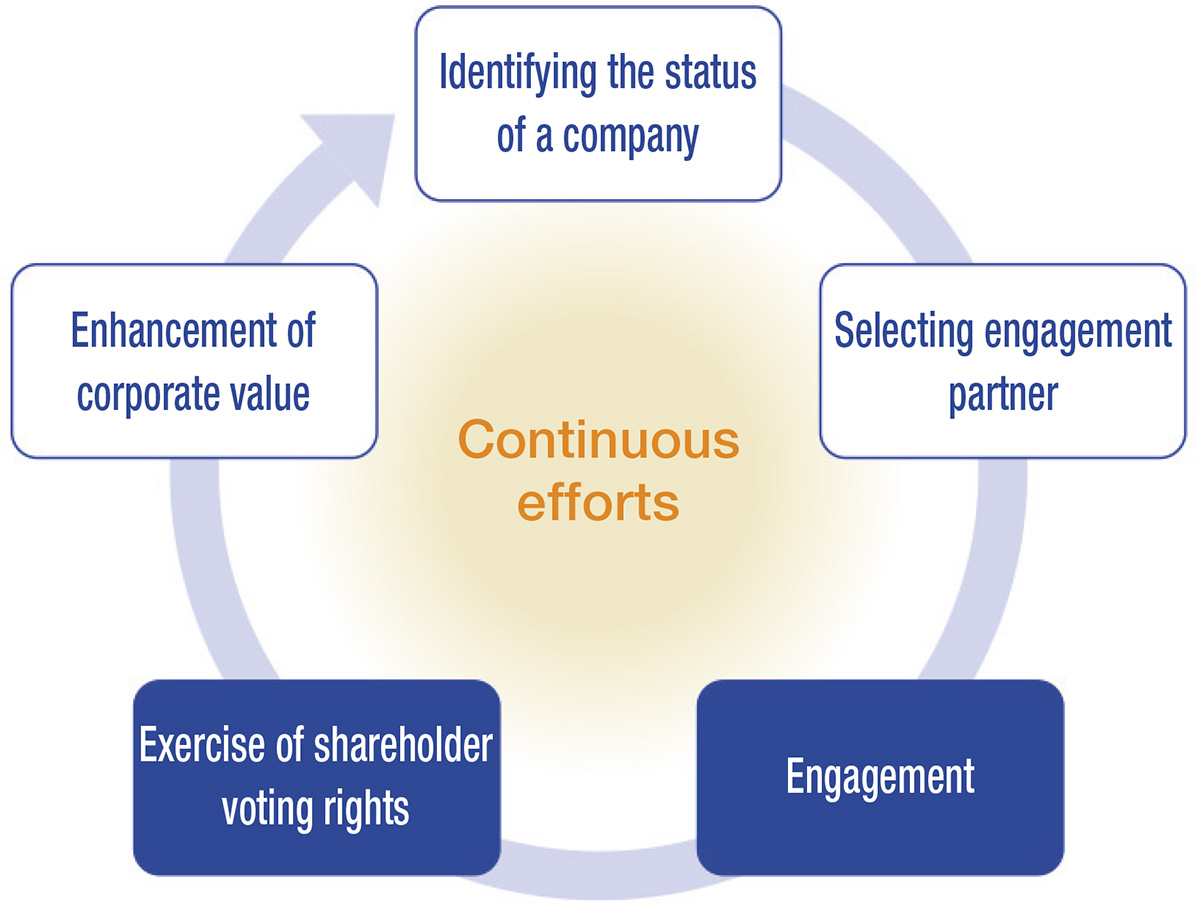

When choosing who to engage in dialogue, discussions are first held within our investment team based on the Stewardship Activities Policy formulated annually. We then engage with each investee in order of priority based on confirmation of the progress of issues shared in the past, level of importance to the portfolio, and specific matters that the person in charge is focusing on (GHG emissions, etc.).

In exercising our voting rights, we basically follow our shareholder voting policy, but we do not make conventional judgments, rather we take into account non-financial information including ESG factors and the status of dialogue, and implement the policy appropriately.

In cases where there are no prospects for constructive dialogue or progress in addressing issues despite carrying out ongoing constructive engagement with investees, where necessary, we will escalate our response in stages by requesting a meeting with management, exercising our voting rights, or reviewing asset allocation.

These stewardship activities are deliberated by the Responsible Investment Advisory Sectional Meeting with external experts.

For more detailed information on our sustainable investments and stewardship activities, please refer to the Responsible Investment Report.

Stewardship Activities Policy

We have established the Stewardship Activities Policy as our response to each principle set forth in Japan's Stewardship Code and our basic approach to all aspects of stewardship activities. We implement stewardship activities in accordance with this policy.

Until FY2021, our stewardship activities under the Stewardship Activities Policy were limited to domestic equities and domestic corporate bonds, but since FY2022 we have expanded the scope of these activities to include other assets by strengthening engagement measures regarding these assets. We undertake stewardship activities using methods based on the characteristics of each asset.

Flow of stewardship activities

Engagement with Portfolio Companies (Constructive Dialogue)

We conduct engagement (constructive dialogue) to support the enhancement of value and the sustainable growth of our portfolio companies. Dialogue is conducted from a medium- to long-term perspective, sharing the status of initiatives related to management strategies and sustainability as well as issues we identify as investors. We also encourage appropriate responses to these issues and the enhancement of information disclosure.

Main Dialogue Themes

- Environment: GHG emissions reduction, climate change, initiatives on natural capital

- Society: Human capital (women's advancement, work environment, etc.), initiatives on human rights

- Governance: Board of Directors composition, director independence, officer remuneration

- Other: Management strategies, information disclosure, shareholder returns, capital policy

Guidelines for electrical power sector

The emission intensity (g-CO2/KWh) standard that the electrical power sector should aim for by 2030 is as follows:

195 to 270 g-CO2/kWh

This standard was formulated based on the Net Zero Emissions by 2050 scenario (NZE scenario) and the Announced Pledges scenario (APS scenario) set out in the World Energy Outlook 2024 release by the International Energy Agency (IEA). The standard that we use will be revised accordingly in response to any changes in the external environment or updates to the aforementioned scenarios.

Responsible Investment Report

We publish a Responsible Investment Report to provide more detailed information on our sustainable investment and stewardship activities.

back issue

- Responsible Investment Report (FY2023)

- Responsible Investment Report (FY2022)

- Stewardship Activities Report(2020.7~2021.6)

- Stewardship Activities Report(2019.7~2020.6)

※ In line with the expanded content of the report, the Stewardship Activity Report was renamed the Responsible Investment Report.

Policy on Exercise of Shareholder Voting Rights

We exercise shareholder voting rights appropriately in accordance with our Policy on Exercise of Shareholder Voting Rights.

Taking into account the growing public interest in sustainability and policy trends, we revised our policy to add provisions related to environmental, social and governance (ESG) issues that contribute to the expansion of corporate value, with the aim of encouraging investee companies to make further efforts to improve their sustainability.

Standards for the Exercise of Shareholder Voting Rights

Since May 2022, we have disclosed our Standards for the Exercise of Shareholder Voting Rights, which set forth specific criteria for the exercise of shareholder voting rights on individual proposals.

Results of Exercise of Shareholder Voting Rights (by Agenda)

The results of the exercise of shareholder voting rights and the reasons for approval or disapproval of each agenda item for our domestic stocks (in-house investment) are disclosed.