Sustainable Investment Policy / Structure

Under our management philosophy, "Be a trustworthy partner for people, always being close at hand and endeavoring to protect their well-being." we consider sustainability (medium- to long-term sustainability, including ESG (environmental, social, and governance) elements) in all of our assets under management. At the same time, we are committed to making investments and loans that contribute to the achievement of the SDGs and the resolution of social issues in a broad range of areas. As a universal owner* that manages a wide range of assets over the long term based on the precious premiums entrusted by our customers, we aim to fulfill our social responsibility to all our stakeholders, realize a sustainable society, and improve long-term investment results.

- *

- An institutional investor investing large amounts and diversifying broadly across overall capital markets

▶ For more detailed information on our sustainable investments and stewardship activities, please refer to the "Responsible Investment Report."

Priority Initiative Themes of Sustainable Investments

We focus on the "enhancement of well-being," "development of local communities and society," and "contribution to environmental protection" as priority initiative themes and make investments with "warmth" unique to Japan Post Insurance.

Sustainable Investment Policy

Our Sustainable Investment Policy clarifies our basic approach to sustainable investment. It stipulates that sustainability factors should be incorporated into the investment process and that we should engage in constructive dialogue and shareholder voting with consideration to sustainability factors.

We manage assets in accordance with this policy.

In stewardship activities, we aim to enhance the corporate value of our portfolio companies over the medium to long term through constructive dialogue (engagement) with them. Moreover, we seek to accurately understand their situations, including aspects such as their sustainability (medium- to long-term sustainability, including ESG (environmental, social, and governance) elements)-related issues and their medium- to long-term management strategies for addressing them. By directly engaging with portfolio companies on issues such as Board of Directors composition, officer remuneration, shareholder returns and other capital policies, information disclosure policies, climate change, biodiversity, human rights, and human capital, we confirm their efforts to address sustainability issues, and share a recognition of these issues.

For more details, please refer to the following Stewardship Activities.

For our policy on addressing sustainability issues such as climate change, natural capital, human rights, and human capital, please refer to the following Engaging with Sustainability Issues as an Institutional Investor.

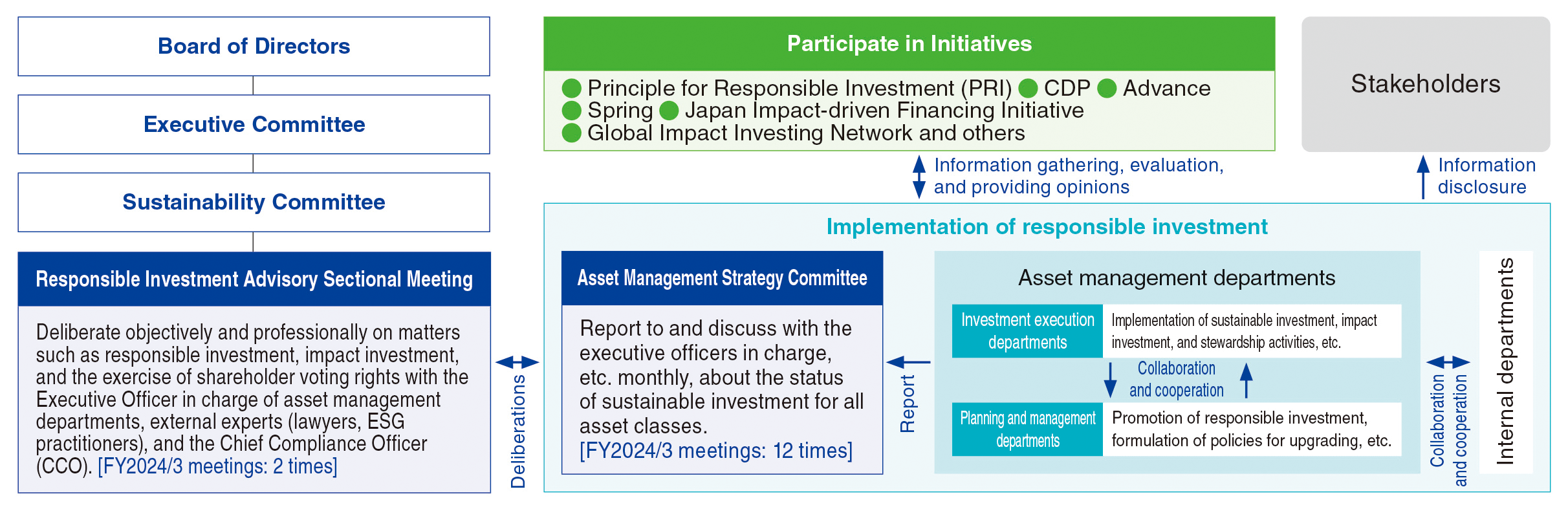

Governance structure for promoting responsible investments

At Japan Post Insurance, we work to promote responsible investment, including sustainable investment and stewardship activities, under the following governance structure.

Through the Responsible Investment Advisory Sectional Meeting, which includes outside experts, as well as participation in various initiatives, we fully utilize outside perspectives and continue to promote and advance responsible investment.

- *

- See "External Evaluation and Support for Initiatives" for details of initiatives.

Initiatives as a Signatory to the Principles for Responsible Investment (PRI)

We signed the Principles for Responsible Investment (PRI) in October 2017. We promote Responsible investments in accordance with the PRI and report the status of the initiatives once a year. We also designate the results of the PRI's assessment of these reports as a key indicator in our initiatives to further enhance Responsible investing.

<PRI annual assessment result (2024)>

The assessment results for the Company in the 2024 annual assessment (assessment period: April 2023 through March 2024) are shown in the table below.

| Assesment item | Assessment resut | |

|---|---|---|

| Policy, governance, strategy (responsible investment approach, structure, etc.) | ★★★★★ | |

| Assets under management (assessment by asset class of manager selection, appointment, moniterring and other initiatives) | Listed equity (passive) | ★★★★★ |

| Listed equity (active) | ★★★★★ | |

| Fixed income (active) | ★★★★☆ | |

| Private equity | ★★★★☆ | |

| Real estate | ★★★★☆ | |

| Infrastructure | ★★★★☆ | |

| Confidence-building Measures (approach in the review and varification of data reported to PRI) | ★★★★☆ | |

- (*)

- Assessment results are awarded up to five stars based on the status of initiatives, with five stars (★★★★★) being the highest rank.

- (*)

- In the 2023 annual assessment, no assessment was carried out for in-house investments approaches by asset owners, including the Company.

- (*)

- For details about assessment results, please refer to the following PRI reports.

Initiative Participation

We participate in domestic and international initiatives that align with our objectives and focus on sustainable investment, impact investment, climate change, human rights, and other social issues, gathering and disseminating information and opinions as we promote and advance our efforts.

Engaging with Sustainability Issues as an Institutional Investor

As a responsible institutional investor, we seek to leverage our investments to solve sustainability issues in order to bring about a sustainable society. Among sustainability issues, we place particular emphasis on the following themes that we see as important both for society and our Company as a responsible institutional investor.

<Policy for Initiatives Related to Sustainability Issues>

| Climate change | Based on the Paris Agreement, a treaty on climate change, we have set a target of net-zero greenhouse gas emissions from our investment and loan portfolio by 2050 (including an interim target for 2030). We evaluate the climate change-related risks and opportunities of investees and reflect them in our investment decisions. We also conduct engagement centered on investees for which climate change poses a considerable risk, and encourage them to reduce greenhouse gas emissions. We also actively invest and provide loans in renewable energy power generation projects and companies promoting the transition to decarbonized operations. We will endeavor to enhance the disclosure of progress with these initiatives and the climate change risk analysis of our portfolio in accordance with the Task Force on Climate-related Financial Disclosures (TCFD) framework. |

|---|---|

| Natural capital | Companies' business activities are dependent on the blessings of nature and the ecosystem (such as water resources, forest resources, and raw materials/ingredients for food and daily necessities). At the same time, the excessive extraction of resources and the release of toxic substances may adversely affect the natural environment. In accordance with the Kunming-Montreal Global Biodiversity Framework and the recommendations of the Taskforce on Nature-related Financial Disclosures (TNFD), which are both international guidelines related to the natural environment, we make investment decisions that take into account the risks and opportunities companies face with regard to the natural environment, with a focus on industries with high exposure on this front. Through dialogue with investees, we also encourage them to implement nature risk management and enhance related information disclosure. |

| Human rights | Human rights are a universal value tied to human dignity. With the globalization of value chains, the risks of human rights violations faced by investees in our asset management operations are becoming more diverse and complex. We respect international guidelines on protecting human rights, such as the United Nations Global Compact, the United Nations Guiding Principles on Business and Human Rights (UNGPs), and the International Labour Organization Declaration on Fundamental Principles and Rights at Work. Accordingly, we make investment decisions while checking the governance (including human rights policies) of investees, as well as their human rights due diligence, relief systems, and other efforts, with a focus on industries and companies identified to have potentially high risk of human rights violations. Through dialogue with these investees, we also encourage them to enhance their responses to human rights-related risks. |

| Human capital | With the servitization and digitalization of the economy, the talent and skills of companies' employees are becoming increasingly important as a source of sustainability. We evaluate investees' human resource initiatives and reflect them in our investment decisions. We consider factors such as consistency between business strategies and human resources strategies, investments in human resources, efforts to secure and develop human resources, and efforts to enhance the diversity and inclusiveness of the workforce. Through dialogue with investees, we also share issues related to human capital and encourage the enhancement of information visualization and disclosure. |

For initiatives related to each sustainability themes, please refer to the following.

Initiatives for Climate Change

In addition to aiming for carbon neutrality by 2050, we have established an interim target of reducing the GHG emissions in our investment portfolio by 50% (compared to FY2020) by the end of FY2029 (March 31, 2030). Furthermore, as an institutional investor, we proactively make investments that contribute to the realization of a decarbonized society in accordance with our Sustainable Investment Policy. In addition, we engage in the following initiatives:

• Implementation of ESG integration

• Implementation of Stewardship activities

• Measurement and management of GHG emissions from the investment portfolio

• Promoting investments that contribute to the decarbonization of society

See "Initiatives for Climate Change" for details of these initiatives.

Initiatives for Natural Capital

As a responsible institutional investor, we are committed to the following:

• Taking natural capital and biodiversity into consideration when making investment decisions and engaging in dialogue with investee companies

• Encouraging our investee companies to enhance their information disclosure and management of nature-related risks

• Analyzing the "nature-related risks and opportunities" and "impact and dependence on nature" of our investment activities

• Endorsing Advance, a stewardship initiative where institutional investors work together to take action on human rights and social issues

See "Initiatives for Biodiversity Conservation" for details of initiatives.

Initiatives for Human Rights

As a responsible institutional investor, we engage in the following initiatives:

• Taking natural capital and biodiversity into consideration when making investment decisions and engaging in dialogue with investee companies

• Excluding companies that engage in business related to inhumane weapons as potential investees

• Endorsing Advance, a stewardship initiative where institutional investors work together to take action on human rights and social issues

See "Human Rights" for details of initiatives.

<Reference: Endorsement of collaborative stewardship initiative "Advance">

"Advance" is a stewardship initiative established by PRI where institutional investors work together to take action on human rights and social issues.

As a responsible institutional investor, we will give consideration to human rights in our investment decisions and stewardship activities in order to promote a positive impact on human rights and social issues.

- *

- Japan Post Insurance is an Advance endorser and does not participate in any engagement activities in Advance.

Initiatives for Human Capital

As a responsible investor, we also give consideration to human capital in asset management as well as encourage human capital initiatives and enhanced related information disclosure in our engagement with investee companies and other undertakings.

See "Human Capital Management" for details of these initiatives.

Spreading Opinions and Information on Sustainable Investment

As a universal owner contributing to the sustainable growth of society as a whole, we communicate our opinions and policymakers through initiatives regarding the issues and requests that we consider important in order to promote sustainable investment. Additionally, we share information on sustainable investment with all stakeholders, including our customers.

<Communicating opinions>

| External committee membership, etc. |

• Member of the ESG Investment and Finance Working Group and the Stewardship Activities Working Group, The Life Insurance Association of Japan • Member of the Working Group on Impact Investment (Financial Services Agency) • Member of the Study Group on Impact Investment (Financial Services Agency, GSG-NAB Japan) • Committee member of Japan Impact-driven Financing Initiative (IDFI) • Director of the Future Design Initiative by Science and Finance (FDSF) • Discussion member of the Market Research & Formation Subcommittee, Impact Consortium |

|---|---|

| Policy engagement/ recommendations |

• Dialogue and exchange of opinions with policymakers and relevant authorities in various countries • Communication of opinions for the revitalization of the stock market and the realization of a sustainable society through policy recommendation reports (The Life Insurance Association of Japan) • Sharing opinions through initiatives, etc. (CDP, Investor Agenda, etc.) |

<Spreading infotmation>

| Seminars and other events | Our executives and employees disseminate information on sustainable investment at seminars and other events. |

|---|---|

| Lectures at universities and other educational institutions | To contribute to the development of the next generation of financial professionals, we hold lectures on sustainable investment at universities and other educational institutions. We keep the content practical, explaining the significance of sustainable investment, describing our specific initiatives and their results, and sharing other information with investment case studies. For more information about this initiative, read about our "Social Contribution Activities." |

| Spreading information in multiple directions | We use a variety of media to share information on our sustainable investment initiatives with our stakeholders in ways that are easy to understand. <Reports> - Annual Report - Sustainability Report - Responsible Investment Report <Online Media> - Japan Post Insurance Junction (in Japanese) - JP CAST (in Japanese)  |

Responsible Investment Report

We publish a Responsible Investment Report to provide more detailed information on our sustainable investment and stewardship activities.

<Backnumber>

- Responsible Investment Report (FY2023)

- Responsible Investment Report (FY2022)

- Stewardship Activities Report (2020.7~2021.6)

- Stewardship Activities Report (2019.7~2020.6)

- *

- Accompanying the expansion of its content, the "Stewardship Activities Report" was renamed the "Responsible Investment Report" in FY2022